Profit First and InventoryLab – Making Cash Work for You!

Good news! Today we’re going to discuss how to use InventoryLab to assist in managing your Profit First Cash Flow system. I’m excited to share this with you because it represents a breakthrough in my thinking that occurred while I was on my 4-week vacation recently.

Earlier this year, Jeff Campbell of InventoryLab and I conducted a webinar to the IL audience, and someone requested a webinar on how to do Profit First Cash Flow Management using InventoryLab software. I gave it some thought and even had a brainstorming session with Jeff to see how it might work using the conventional approach. I was stuck. It just didn’t seem possible. Getting away from the office while on a hiking trail in Zion National Park, I realized some tweaks that can be done to create a new process of the Profit First method that can be used with InventoryLab. I’m going to walk you through that process below.

If Profit First is not a familiar concept and you have concerns about how to manage your cash, then head over to my blog and dig into the Profit First categories. You can also read my book Profit First for Ecommerce Sellers to get the full scoop. If you’re not familiar with taking a 4-week vacation, then you need to read Mike Michalowicz’s book, Clockwork to learn how stepping away from your business is good for you and for your business.

Now, Let’s Get Into the Profit First/InventoryLab Method

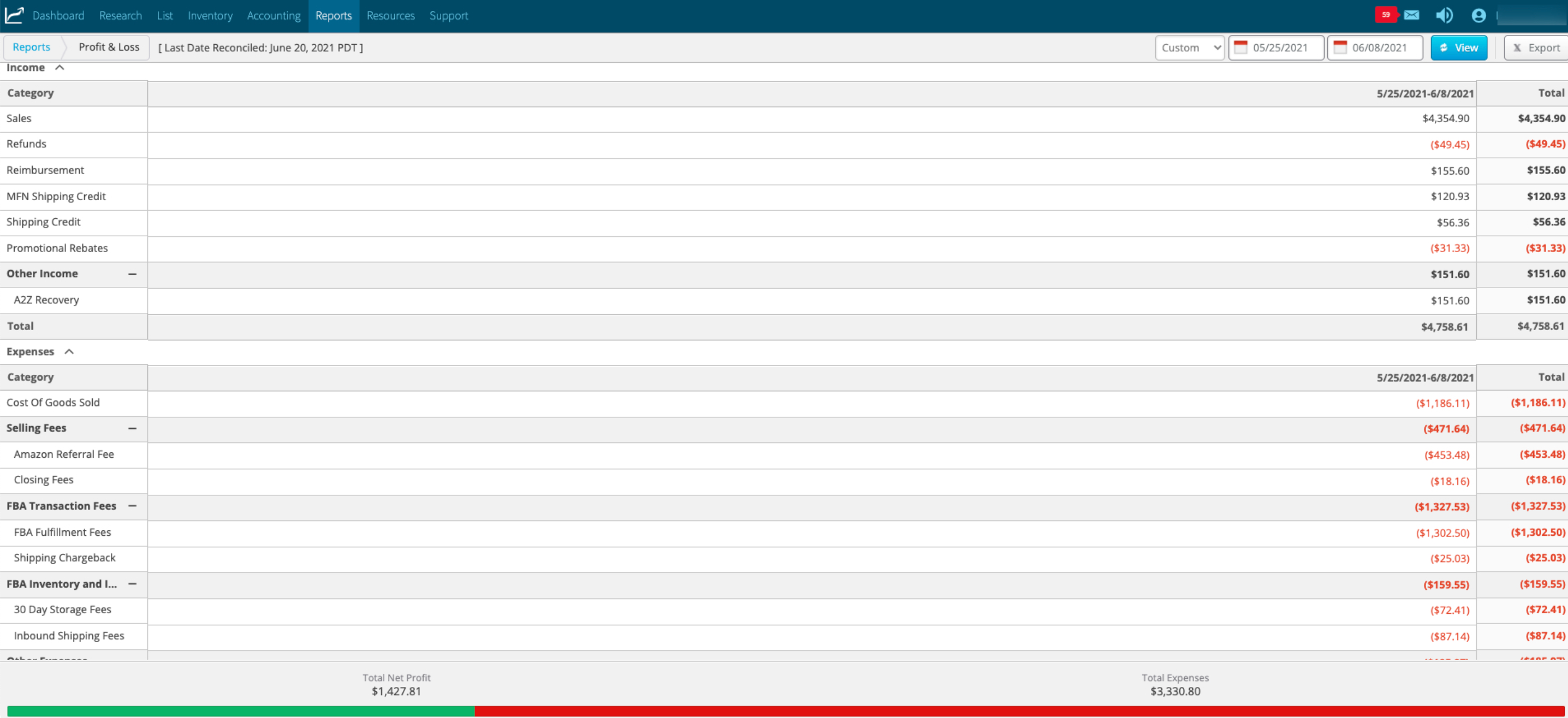

Step 1: When you receive your deposit from Amazon, log into your IL account to determine your Cost of Goods Sold for the products that were sold during this settlement period. Be sure to have all your buy costs up to date and look at the same time period that is represented in your Amazon settlement. For example, if your Amazon payout is for May 25- June 8, then set those dates for your IL Profit and Loss Report. Determine your Cost of Goods Sold amount, and we will use it in the next step below.

Step 2: Since you are familiar with Profit First, you understand that bank accounts are used for specific purposes. I recommend you start with three bank accounts as a “Quick Start Method.” These three bank checking accounts are: Inventory, Profit, Operating Expense. You may have more if you’ve been doing Profit First for a while, but I’m outlining a method that is a safe place for all to start. Once you have this down, you can add other accounts such as Owner Pay and Taxes. I assume that your Amazon payout will go into your Operating Expense Checking account. Once the funds are in your account, transfer the amount of the Cost of Goods Sold (step 1 above) over to the Inventory checking account. Then take 1% of what is left and transfer it to your Profit Account.

Step 3: When you purchase inventory in the future, pay for it from your new Inventory Checking Account. The funds you have transferred in will ensure that you are always using your sales to fund future purchases. If you are wanting to grow, determine what your cash will allow, and add a percentage above the Cost of Goods Sold actual amount your pulled from your IL Profit and Loss report. Many of my clients add 5 to 10 percent to ensure that their inventory checking account balance is growing, which allows their business to grow without taking on expensive debt.

Step 4: Your Profit Account will grow slowly at 1%. You want to steadily increase it. Most people can easily identify something to delete from their operating expenses that will allow them to set aside that 1 percent. But you want to do better than that over time. Each quarter, identify another 1 percent that you can cut from your operating expenses. As you do, then bump up your profit allocation percent by that amount. The idea is that you’re putting pressure on your operating expenses to stay low, so you operate as lean and efficient as possible. By doing that, you’re setting aside money to reward yourself for your efforts as a business owner. Because really, didn’t we go into business for it to reward us? Not for it to be a cash-eating monster that also sucks away our time, too!

Step 5: Every quarter, look at the money you added to your Profit Account. Take 1/2 of the amount you added and do something fun for you and your family. DO NOT plow it back into the business. That defeats the purpose. The business should be able to operate and generate profits to reward you, the owner. If it doesn’t, you have issues that need to be resolved.

You’re probably wondering what will happen to the other half that you leave in the account. The answer is nothing. That money sits there and accumulates until you get 3-6 months of expenses set aside. This fund is your rainy-day fund! Should Amazon lose your inventory or suspend your account, you have funds set aside to weather the storm. This helps in a couple of ways. It gives you the cash to operate and it takes away the anxiety of making a hasty decision because you actually have the cash to get your through the crunch.

Step 6: Repeat the allocations to your accounts every Amazon payday! Repeat the Profit Distribution every quarter. Every quarter, analyze your Operating Expenses and adjust your percentages to increase profit and reduce operating expenses. As you get confident in your process, then consider when it’s time to set aside funds for Owner Pay and Taxes.

This Approach is a “Beach Entry” As Opposed to a Cliff Dive

I want you to go slow. If you rush in, you may shock your cash and set yourself up for insufficient funds charges and the frustration of moving money back and forth with no real purpose. When you get the system dialed in, you will be able to look at your bank accounts and know how your business is performing. You don’t need to wait on your accountant’s financial reports because you can get real time data by using your online bank accounts as a dashboard.

Of course, I have simplified this for the purpose of this blog. I’ll be doing another InventoryLab webinar on July 8th with Jeff Campbell and Kim VanDenburgh as part of their new series, Open Lab, which will be available on YouTube or Facebook. During the webinar, we will be discussing what you can do right now to prepare for Q4, along with tips and tricks to help you manage your business finances better. We’ll also have time set aside to answer questions from the viewers!

Interested in Profit First?

![]() If your eCommerce business isn’t where you’d like it to be in terms of profitability, check out my book, Profit First for Ecommerce Sellers. It answers important questions about how to implement Profit First in an eCommerce business. Take control of your money and your business, and put Profit First to work for you!

If your eCommerce business isn’t where you’d like it to be in terms of profitability, check out my book, Profit First for Ecommerce Sellers. It answers important questions about how to implement Profit First in an eCommerce business. Take control of your money and your business, and put Profit First to work for you!

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for eCommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all of our eCommerce accounting and profit advising services here!

Want to get FREE Ebook? Download now!

Try InventoryLab Today

30 Day Free Trial

Save time and money by streamlining your Amazon business. Source, List, Ship, and Analyze all in one place.

Get Started

Comments(0)